In the second part of the series, I use a simulation approach to test the likely adequacy of natural gas supplies during the upcoming heating season. In these simulations, I use data from the UK Department of Business, Enterprise, and Regulatory Reform (BERR), UK National Grid, as well as information about recent UK Continental Shelf (UKCS) and Norwegian Continental Shelf (NCS) develpments. Based on what I refer to as the reference scenario, it seems likely that the UK will increasingly have to rely on Liquefied Natural Gas (LNG) imports to secure adequate supplies.

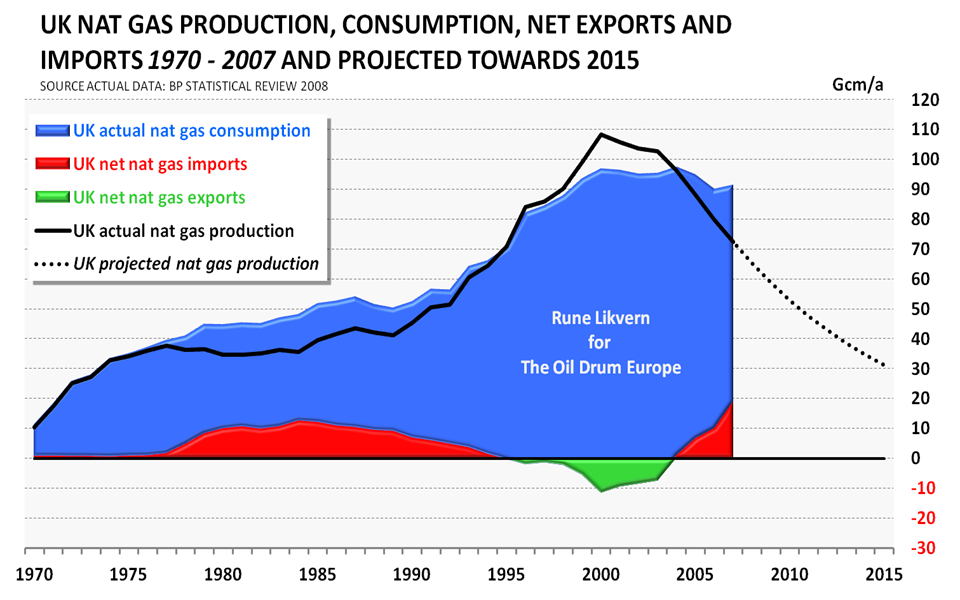

UK Natural Gas Supply and Demand Projection to 2015

In recent years, the UK has become increasingly dependent on natural gas as its primary energy source. This strategy may soon be found to be based upon poor assumptions/perceptions regarding development of domestic and neighbouring natural gas reserves and, in general, regional and global supply capabilities.

* UK marketable nat gas production (also gross) peaked in 2000 close to 110 Gcm/a.

* During the last three years, UK nat gas production has declined at an annual rate of 8 - 10 %, which many energy analysts expect will continue.

* Nat gas constituted more than 38 % of the UK primary energy consumption in 2007.

* Several analyses expect UK to import 80 % of their nat gas consumption by 2020.

* UK was a net exporter of nat gas for a brief period.

In 2007, more than 38 % of the UK's primary energy consumption came from nat gas. Of the EU/OECD countries, only Italy has a higher portion of nat gas consumption. In comparison, the USA gets 25 % of its primary energy consumption from natural gas; France, 15 %; and Germany, 24 %.

In general, high nat gas usage is primarily found among countries with huge nat gas reserves like Russia, where nat gas amounted to more than 57 % of primary energy production in 2007. Russia is the world’s largest exporter of nat gas and second largest exporter of oil, so this high domestic usage frees up oil for export. Since oil generates more income than nat gas, based on units of energy exported, this approach maximizes export revenue.

The UK and Continental Europe have both benefitted from the bidirectional Interconnector that since 1998 has allowed for increased flexibility in nat gas supplies. Due to the decline in UK indigenous supplies and a tighter supply situation on Continental Europe, the importance of the Interconnector is expected to slowly diminish unless future Russian supplies are shipped through the system to UK.

See the full article here:

http://europe.theoildrum.com/node/4699

http://europe.theoildrum.com/node/4699

Homepage:

Homepage:

Comments

Display the following 2 comments